Demand Propagation Through Traded Risk Factors

with Yu An

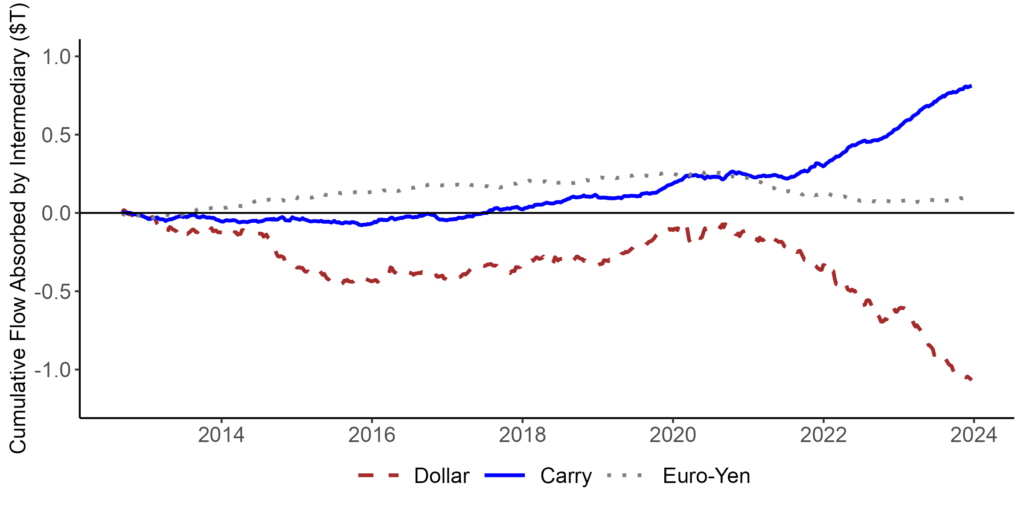

We develop a risk-driven framework to quantify how demand shocks to one asset reprice others, and find that intermediaries’ aversion to non-diversifiable risk is a key friction driving shock transmission. We construct risk factors using both prices and quantities, and exploit the joint orthogonality of returns and flows to estimate factor's price sensitivity using IV.

- Sept 2025