Geoeconomic Competition and Capital Reallocation in Global FX Funding

with Yu An

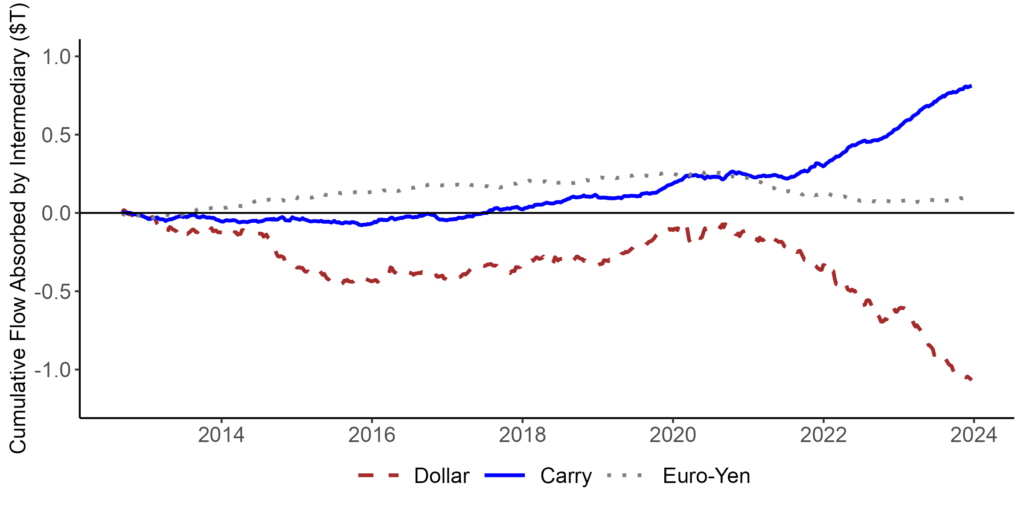

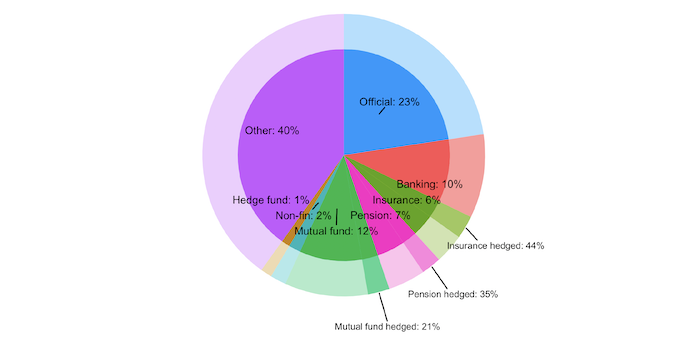

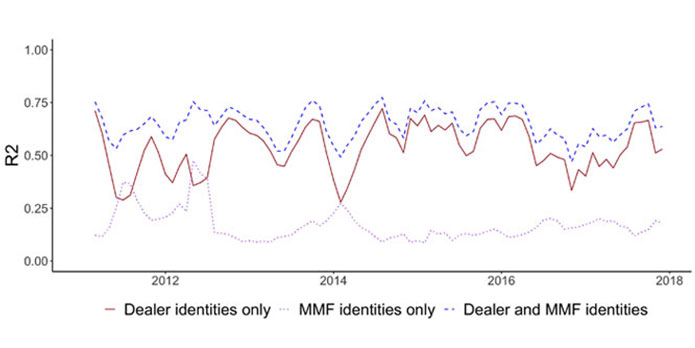

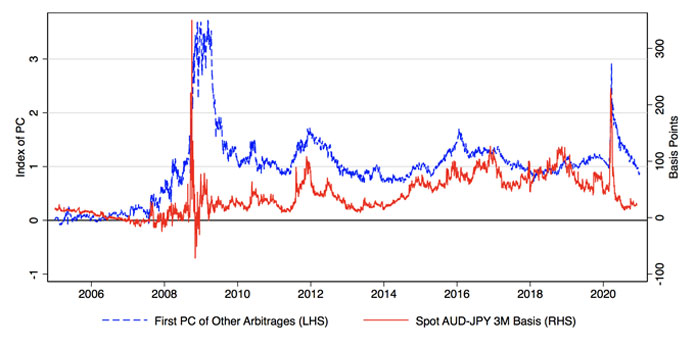

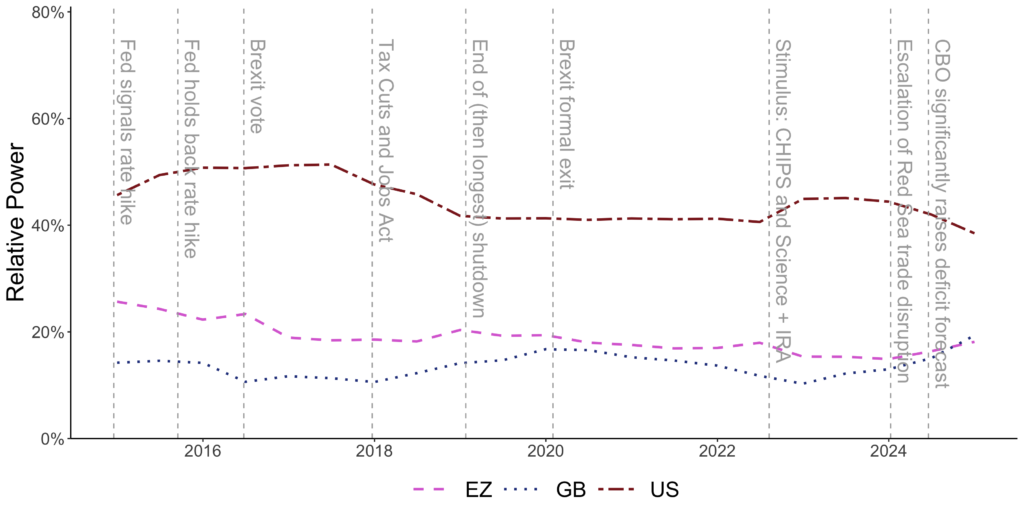

We quantify geoeconomic competition in global FX funding by measuring how one country's funding inflow responds to another country’s actions, which we call ``reallocation exposure.'' We use reallocation exposure to construct time-varying measures of geoeconomic power and characterize the network of financial competition and cooperation.

- NEW!